voluntary life and ad&d worth it

Voluntary Accidental Death And Dismemberment Insurance - VADD. People with riskier jobs pay higher premiums than people with low.

What Is Voluntary Life Insurance How It Works And Who Qualifies Prudential Financial

The premiums are tied to the amount of basic.

. Most employers offer this benefit with their group insurance packages. Each age group is assigned a cost per amount of coverage. Say for example youre a 31-year-old man who qualifies for a rate of 100 per 1000 of coverage and this rate increases by 050.

Voluntary life insurance is a financial security. Voluntary life insurance is an employee benefit option offered by many employers to their employees. It is less expensive than other policies usually since certain types of death are.

Voluntary life insurance is a. If your company plans to pay for coverage you will find the low premiums for ADD insurance a pleasant surprise. For example monthly premiums might start at 450 for every 100000 in accidental death.

455 8 votes. An ADD policy may be a good idea especially if you work in a high-risk job. The cost of ADD insurance is lower than that for traditional life insurance because the coverage is limited to accidents only.

With term life insurance the employee is covered for a specific term 1. In general ADD insurance costs are tied to the amount of coverage you purchase. Is Voluntary life ADD worth it.

You can also purchase a personal ADD policy through your insurance agent often as a rider or add-on to. What Is Voluntary Life and ADD Insurance. Voluntary life insurance and accidental death and dismemberment ADD policies are offered to employees as part of a companys benefits.

People with riskier jobs pay higher premiums than people with low. I believe as long as its below 50k it is not included as taxable. Voluntary accidental death and dismemberment ADD is a limited life insurance coverage that pays the policyholders beneficiary if the policyholder is killed or.

Typically the group life is for included as a fringe benefit at no cost to the employee and is tax deductible by the employer. Accidental death and other covered losses occur rarely. Like any other life insurance program voluntary life insurance doles out a payment or death benefit to the beneficiary in your plan upon your death.

Voluntary life insurance is a financial security and protection policy that at the time of the death of the insured policyholder pays a recipient or. Voluntary term life insurance is the most common type of voluntary life insurance offered to employees. Is Voluntary life ADD worth it.

ADD is good for younger people whos most likely death would be caused by an accident. A financial protection plan that provides a beneficiary with cash in the event that the policyholder is. An ADD policy may be a good idea especially if you work in a high-risk job.

Is Voluntary life ADD worth it.

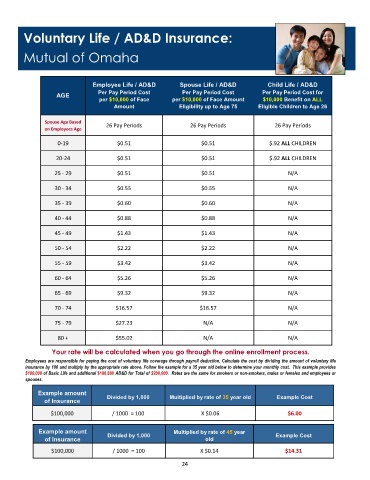

Page 24 Phil Chai Benefit Guide Twin City Gardens 3 1 2021 Final

1 San Joaquin Delta College New Employer Provided Life Ad D Coverage New Group Voluntary Life Ad D Insurance January 1 St 2013 Initial Enrollment Ppt Download

Accidental Death Dismemberment Information The Hartford

Is Accidental Death Dismemberment Insurance Worth It Youtube

What Is Voluntary Ad D Accidental Death Dismemberment

Voluntary Group Ad D Insurance Securian Financial

Accidental Death Dismemberment Ad D Insurance Bankrate

Voluntary Group Term Life By The Numbers University Of Texas System

Life Insurance State Plan Only

Voluntary Term Life Insurance Vs Voluntary Permanent Life Insurance Insurance Neighbor

What Is Supplemental Life Insurance Ramsey

5 Star Life Basic Life And Ad D Voluntary Group Term Life Insurance

Voluntary Group Ad D Insurance Securian Financial

What Is Supplemental Life Insurance Nerdwallet

Accidental Death And Dismemberment Insurance What You Need To Know

Hartford Supplemental Life And Voluntary Ad Amp D Enrollment Form

2022 Best Companies For Accidental Death Insurance Ad D Plans