nanny tax calculator texas

How will changes in my income deductions state change my take home pay. Personal finance teaching aid.

Texas Nanny Tax Rules Poppins Payroll

Pensions property and more.

. Since 1937 our principled research insightful analysis and engaged experts have informed smarter tax policy at the federal state and global levels. For self-employed individuals are responsible for the full tax of 29. Nanny tax and payroll.

We use the Consumer Price Index CPI and salary differentials of over 300 US cities to give you a comparison of costs and salary. Learn about salaries benefits salary satisfaction and where you could earn the most. HSAs are pre-tax accounts that can be used toward health or medical needs.

Simple Nanny Payroll isnt too fancy but its definitely a step above a spreadsheet. I you are not at least 18 years of age or the age of majority in each and every jurisdiction in which you will or may view the Sexually Explicit Material whichever is higher the Age of Majority ii such material offends. Apple iPhone 13 Pro - 128 GB - Graphite.

Paw Brands PupProtector Waterproof Throw Blanket White. The Tax Foundation is the nations leading independent tax policy nonprofit. This website contains information links images and videos of sexually explicit material collectively the Sexually Explicit Material.

January 29 2022 1218 am Thats a interesting read. The 2022 HSA contribution limit stands at 3650 for individuals and 7300 for families. The AARP Job Board was designed with you in mind.

Using a nanny payroll service can greatly reduce the amount of time it takes you to pay your nanny withhold your nannys taxes file your own taxes and stay up-to-date on state and federal changes to tax laws to ensure youre always in compliance. Without needing help from the government which is why petitioners must prepare an I-864. We feature Cam Whores from all across The United States Canada The UK Europe and beyondBrowse through our vast variety of cam models and youll find girls guys couples and transgenders specializing in every kind of sexual fantasies and fetishes.

RATE HOURS PER WEEK. 28 060432 PAYROLL ACCOUNT REGULAR 80 640. I didnt know you could also form a club and differently split the.

For Partners 888 273-3356. Match your years of valuable experience with employers that are committed to an age-diverse workforce. The Medicare tax is a flat tax on all compensation income which is located in box 5 of your W-2.

Welcome to Cam Whore Nextdoor. Contributing to a health savings account HSA is a great way to both minimize your tax burden and save for future health and medical expenses. Calculations are based on the latest available federal and state withholding tables.

The average salary for a Attorney is 89366 per year in United States. Get The Wall Street Journals Opinion columnists editorials op-eds letters to the editor and book and arts reviews. We offer you free hot sex chat and live porn cams with horny amateur and pornstar models around the globe.

To improve lives through tax policies that lead to greater economic growth and opportunity. Medicare tax is also deducted from an. Use GrossNet to estimate your federal and state tax obligations for a household employee.

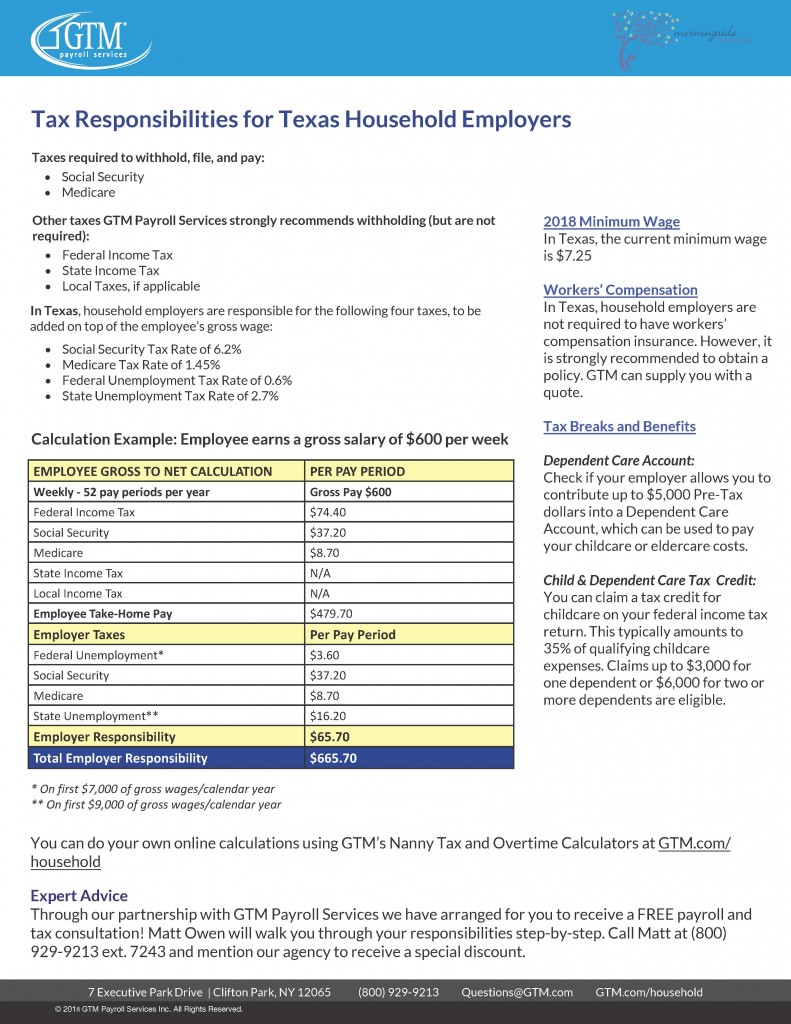

For over 80 years our goal has remained the same. Easy-to-use nanny tax calculator provides estimate of tax responsibility for a householder employer and tax withholdings for nanny or other domestic worker. Learn how much should you be paid in 2022.

Start Your Job Search Here AARP connects you with employers that value your experience. Half the Medicare tax or 145 is paid by the employer. Tell us about your family.

GROSS PAY Select your state. Enter your caregivers payment info. Get Started with Simple Nanny Payroll.

Our easy-to-use budget calculator will help you estimate nanny taxes and identify potential tax breaks. Hatch Restore - Sound Machine Smart Light Personal Sleep Routine. Log in 888 273-3356.

Nanny tax and payroll calculator. Let us help you make an informed decision about what it will cost to live and work in the city of. Latest news expert advice and information on money.

Navigate to the page 3. Telephone or email support is only available to paid SCS clients. Five Nights at Freddys Vanny Vanessa 12.

One of the US. United States Member 125760 March 30 2012 87 Posts Offline. If you want a nanny payroll provider with.

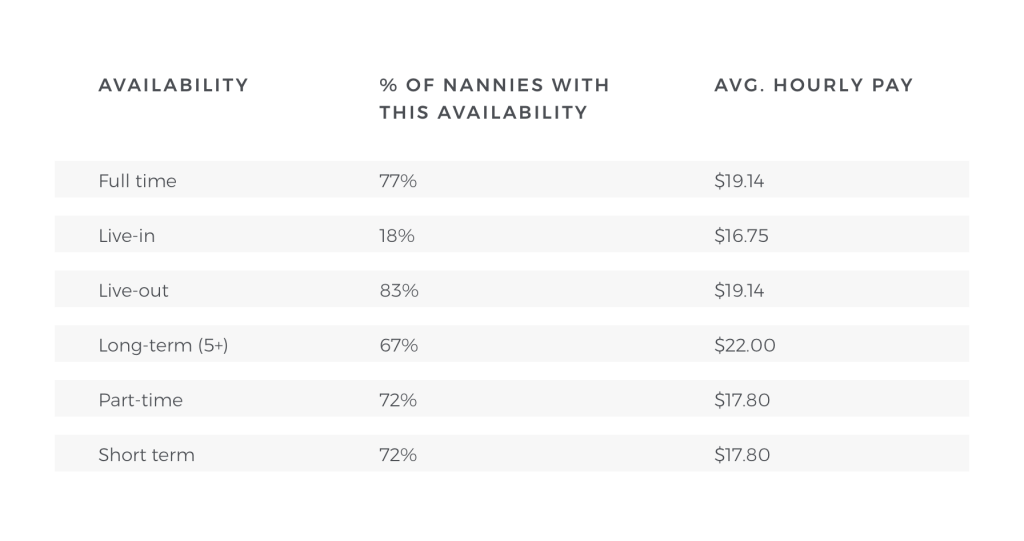

Nannies and other household employees are covered by the Fair Labor Standards Act which means they must be paid the prevailing minimum wage rate. See if your city made the full list. About GTM Household Business.

Join the largest sex webcam community. Governments main concerns with regard to family-based immigration is whether the new immigrants will have enough financial backup to live in the US. Use Salary vs Overtime to.

Local taxes are not calculated. The right small-business tax software can simplify your end-of-year tax filing which means less hassle and stress. If youre on a pretty limited budget and want to make sure youre calculating taxes correctly its a solid choice.

The other 145 is paid by the employee. You can certainly pay your nanny and calculate end-of-year taxes for both of you on your own but unless youre an. Verification of Employment and Income.

Do NOT continue if. The federal minimum wage rate was raised to 725hour in 2009. The payroll calculator is pretty handy and the service costs only 29 for a full year.

The rate is 29 as of 2020 and still current into 2022. Payroll Calculator is available with 2022 Federal and New Mexico tax rates Jan 25 2018 This is the first in a three-part series of articles about California wage statement laws. Best of allmost of the games can be adapted to all levels.

Minimum wage rates are on the rise for 2022 in many states counties and cities across the country.

Can I Deduct Nanny Expenses On My Tax Return Taxhub

The Right Time To Put A Nanny Or Caregiver On The Books Hws

How To Pay Your Nanny S Taxes Yourself Nanny Tax Payroll Template Nanny Payroll

Nanny Tax Payroll Calculator Gtm Payroll Services

Nanny Tax Calculators Nanny Payroll Calculators The Nanny Tax Company

.png?width=800&name=2017%20W-2%20FORM%20(2).png)

W 2 Reporting Required For Nanny Tax Free Healthcare Benefits

2018 Nanny Tax Responsibilities

Nanny Tax Payroll Calculator Gtm Payroll Services

Why Do People Act Like California Has Insane High Taxes But Texas Doesn T I Just Typed Up On The Smartassets Tax Calculator And If You Make 31 000k A Year Or 15 An

Texas Nanny Tax Rules Poppins Payroll

How Much Should I Hold Out For Taxes On 500 A Week In Texas I M A Nanny For A Family And They Don T Take Taxes Out Of My Pay Quora

How Much Do I Pay A Nanny Nanny Lane

Nanny Tax Calculator Gtm Payroll Services Inc

Nanny Tax Payroll Calculator Gtm Payroll Services

Tax Calculator For Families Of East Wind Nannies Gtm Payroll Services Inc

Nanny Tax Calculator Gtm Payroll Services Inc

What Is The Nanny Tax Nanny Tax Tools